Advantages of Solar Energy for Home and Business

For Homeowners

You own the wiring in your house and its roof, and as homeowners, we can do our own electrical work. For the cost of an old used car, you can generate much of your own electricity. There is no question that you can save quite a significant amount on the cost of your system by spending part of a day installing it with the help of family, friends, or neighbors. We are a not-for-profit corporation that:

- researches for the highest quality hardware;

- organizes orders by families and businesses into bulk buys that save everyone substantial money;

- and then, step-by-step, we advise on how to install large and small arrays. We’ve provided hardware and shared our DIY experience on over 100 systems in north-central Kansas.

The “plug ‘n play” has taken the guesswork out of array and inverter wiring. The plastic connectors on both the inverters and panels can fit only one way, so there is almost no concern with cross-wiring. And because each panel has its own inverter, you are working safely with only 47 volts DC. Even that only becomes live when it’s safely wired and the last breaker is switched “on” in your breaker panel.

We highly recommend hiring a licensed electrician to run the cable from your array to your breaker panel. This is garden variety electrical work, which is well within the skills of most any local electrician. This cost, too, can be added to the 30% Federal Income Tax Credit.

Many people feel unsafe on a roof. This risk can be greatly reduced by installing a ground-mounted frame where work can be done from the ground or a stepladder.

Solar for Business

Like homeowners, solar for business is not a huge commitment of time, financing, or effort. Any combination of owners, employees, and local electricians’ shops can install an array.

There are two great solar advantages for businesses:

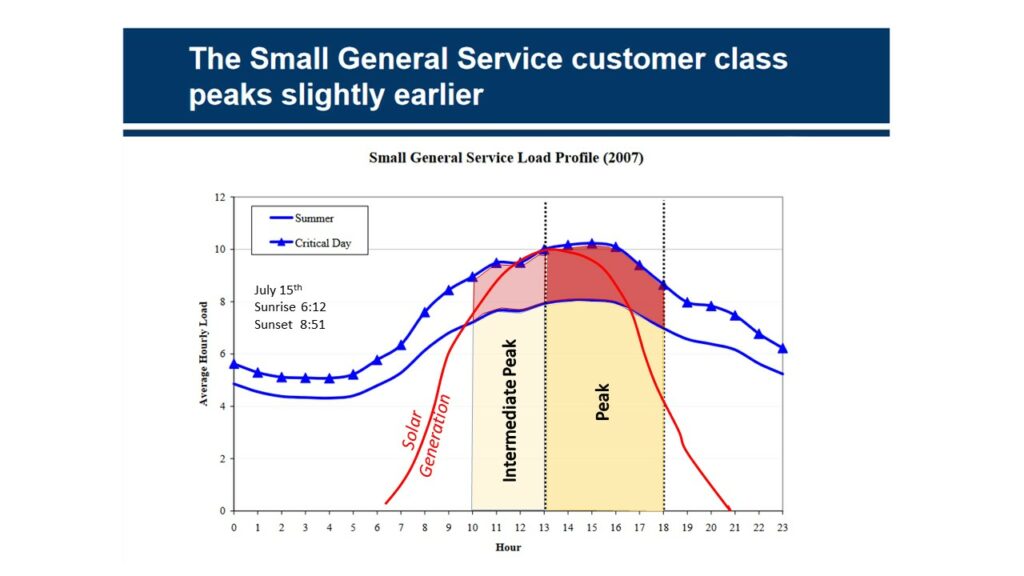

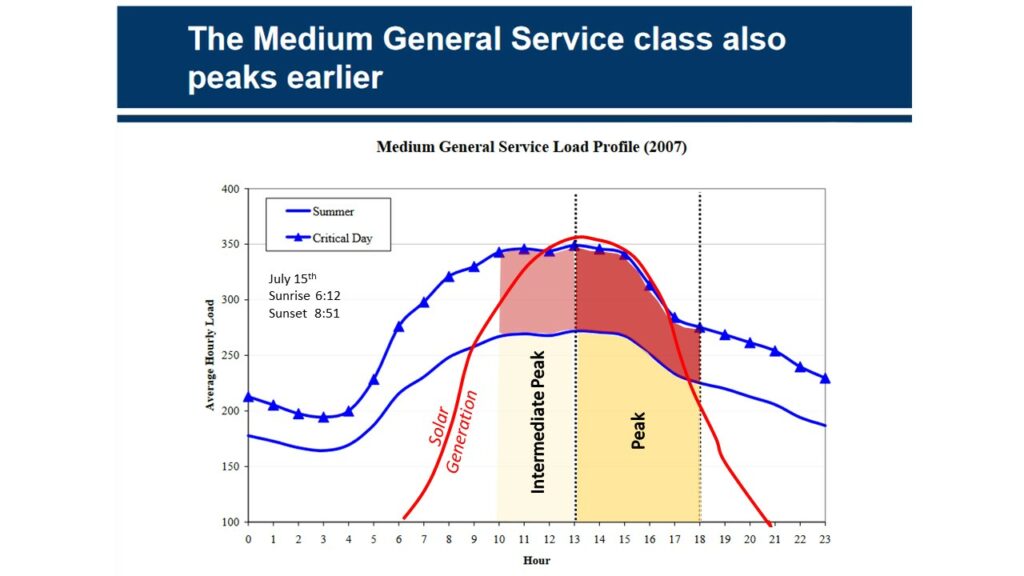

- Small to large business buildings (including city offices and schools) already have a use profile that matches solar power production. Most offices open at 9:00 am and close at 5:00 pm:

- Businesses not only receive the 30% Federal Renewable Energy Income Tax Credit, but rural businesses also qualify for the Renewable Energy in Agriculture (REAP) Grants through the USDA for 25% of the system cost. After that, businesses also can use accelerated depreciation on the remaining amount. Your simple return can be a few years, and your company gains a universally positive public image. From Evergy’s customer survey, 91% of Kansans favor the use of renewable energy.

Additional Resources for Homeowners and Businesses

We are a not-for-profit corporation but still have insurance, advertising, and office expenses. We will charge a third-off our overhead (10% instead of 15%) for systems ordered in multiples of single pallets of solar panels (30 panels) with all array hardware. With this option, we will still advise on installation but not organize a SunRaiser. See our Resources area to get an overview and our most recent price sheet for today’s systems.